Re-financing mortgage prices vary based on the mortgage quantity and also the factors or even rates from the customer. Based on Wikipedia description, re-financing describes the actual alternative of the current financial debt responsibility having a financial debt responsibility showing various conditions; as well as based on this the most typical customer re-financing is perfect for a house home loan. Nevertheless, when the alternative associated with financial debt happens below monetary stress, it’s known as financial debt restructuring and never re-financing associated with financial loans.

Exactly how refinance mortgage prices tend to be decided?

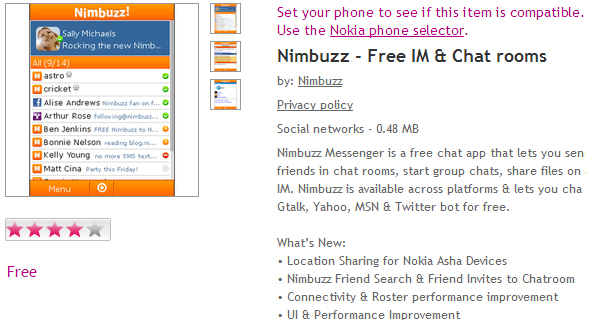

Generally, refinance mortgage prices tend to be decided based on the in advance repayment the industry particular portion from the complete mortgage quantity included in the procedure for re-financing financial debt. Because is actually apparent, the total amount is actually indicated within ‘points’ known as rates. Every stage is recognized as equal to 1% from the complete mortgage quantity as well as, consequently, just in case the actual refinance choice chosen entails having to pay 5 factors, then your customer will have to spend 5% from the complete mortgage quantity in advance.

Basically, refinance financial loans tend to be come to adjust the actual monthly obligations due about the mortgage possibly through altering the actual loan’s rate of interest or even through changing the word in order to maturation from the mortgage; both pointed out advantages could be reported because top cause of enhanced monetary condition from the customer. Re-financing mortgage prices assist in bringing together the actual financing problems as well as producing all of them much more advantageous through decreasing general credit expenses in order to debtors.